Folks, listen up because this is important. While we’re a gaming a geek culture site, there’s nothing more serious than neglecting your credit. Especially when someone else does it and you need to pay attention. Around May 2017, Equifax was under an ongoing hack and it wasn’t until July 2017 when they officially noticed this hack occurring.

However, they only recently made an announcement of this hack, leaving many of us wondering what should we do.

September 7, 2017 — Equifax Inc. (NYSE: EFX) today announced a cybersecurity incident potentially impacting approximately 143 million U.S. consumers. Criminals exploited a U.S. website application vulnerability to gain access to certain files. Based on the company’s investigation, the unauthorized access occurred from mid-May through July 2017. The company has found no evidence of unauthorized activity on Equifax’s core consumer or commercial credit reporting databases.

The information accessed primarily includes names, Social Security numbers, birth dates, addresses and, in some instances, driver’s license numbers. In addition, credit card numbers for approximately 209,000 U.S. consumers, and certain dispute documents with personal identifying information for approximately 182,000 U.S. consumers, were accessed. As part of its investigation of this application vulnerability, Equifax also identified unauthorized access to limited personal information for certain UK and Canadian residents. Equifax will work with UK and Canadian regulators to determine appropriate next steps. The company has found no evidence that personal information of consumers in any other country has been impacted.

It’s been estimated that over 143 million peoples personal information has been affected. Driver’s licenses, birth dates, addresses and social security numbers – meaning someone has your information. This can lead to your information being sold and used to open up fraudulent accounts in your name. Definitely not a good situation to be in.

Update: The original link to Equifax’s site was removed. Head here to see the implications and impact of this compromise.

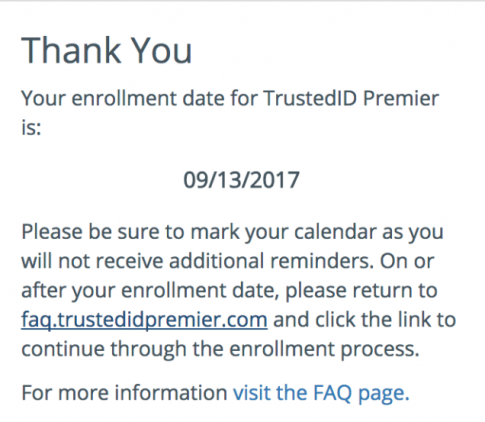

For now, Equifax has set up a website that you can check to see if you were impacted. Head over to *no longer works https://www.equifaxsecurity2017.com/potential-impact/ *to get the process started. It will ask for the last six of your social security numbers and your last name. Based on this information, it should tell you if you were affected via a message. Regardless if you are on the list at this time or not, you will be eligible to be enrolled for one year of free credit service monitoring.

The enrolled doesn’t occur until sometime later, which isn’t easily apparent. You must return on the date specified if you want to be enrolled.

I’m sorry, but if you were affected, Equifax better be giving out more than just a year of service. It’s their fault, they should be watching this for life in my opinion.

Update: After reading the terms of this monitoring service, it appears that Equifax is trying to pull a fast one. In the terms, it states that if you agree to the service, you waive any and all rights to sue Equifax. What’s more is that isn’t spelled out at the time of the checking and is buried at the bottom of the terms, instead of the top where it supposed to be. It isn’t specified AT ALL during the enrollment process. Not on the main page, not on the FAQ, nowhere. I fail to see how this legal, but here it is. Make sure you read this!

ARBITRATION. PLEASE READ THIS ENTIRE SECTION CAREFULLY BECAUSE IT AFFECTS YOUR LEGAL RIGHTS BY REQUIRING ARBITRATION OF DISPUTES (EXCEPT AS SET FORTH BELOW) AND A WAIVER OF THE ABILITY TO BRING OR PARTICIPATE IN A CLASS ACTION, CLASS ARBITRATION, OR OTHER REPRESENTATIVE ACTION. ARBITRATION PROVIDES A QUICK AND COST EFFECTIVE MECHANISM FOR RESOLVING DISPUTES, BUT YOU SHOULD BE AWARE THAT IT ALSO LIMITS YOUR RIGHTS TO DISCOVERY AND APPEAL.

In any event, a credit monitor service won’t help you if you were affected. However, there are steps to help you if you are impacted.

- Freeze your credit – this will stop people from being able to open up accounts in your name. It basically hides your credit so that institutions can’t see it. And if they can’t see it, they may not approve any credit for that application. However, this service isn’t free and you’ll need to contact all three of the credit reporting companies. https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs

- Equifax — 1-800-349-9960

- Experian — 1‑888‑397‑3742

- TransUnion — 1-888-909-8872

2. Implement a fraud alert. Similar to a credit freeze, a fraud alert will put a hold on your credit for 90 days. However, once you have an active credit fraud alert, it will be spread to the other reporting companies as well.

3. Keep an active eye on your accounts. More than anything, if you notice something odd on your bank accounts or get mail stating you were denied for credit, make sure you follow-up on that. Ignoring this could only complicate matters.

Be sure to stay on top of this, this is important. This affects you and you need to be sure that this won’t impact you more than it has. This could potentially ruin your lives, stop you from getting a car loan or even a house loan.